About Me

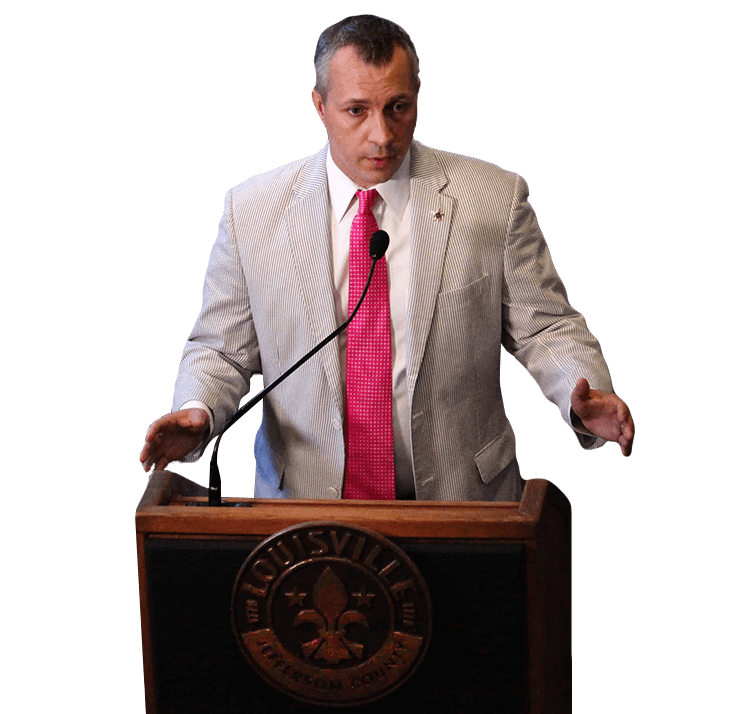

Hello, I’m Sean. I’ve been in the domain industry for over 15 years. I have three successful exits from previous companies, all in the domain space, that I have co-founded and sold. I'm also an author and public speaker in the domaining industry.

I’ve assisted music producers, event producers, attorneys, doctors, publicly traded companies, and more who've needed to acquire domain names or social media handles for their events, brands, and companies. I also act as an in-house domain consultant for multiple large corporations who need a Domainer on staff. I’ve spoken all over the world about the industry of domaining and consult with thought leaders across the professional spectrum when my services need to be employed.

To date I’ve brokered over 10 million dollars worth of domain names and hold a substantial domain portfolio myself. I specialize in discreet domain purchasing, domain reclamation, domaining offense, brand defense, and domain brokerage. In 2007 I authored Domain Graduate, the world’s first and most widely recognized how-to guide for starting a career in Domaining. My book has been translated into five different languages and is used throughout the world to teach newcomers to our industry how to take their initial leap into domaining.

I'm available to do consults for single domain purchases or sales. I also split my domaining time assisting those companies that keep me on retainer as an in-house domainer. I can also secure social media handles for your organization.

If you’re looking for a domain specialist for your organization who knows all the tricks of the domain trade, knows all of the industry power-players, and can help your brand navigate through the ins and outs of the domain world, then you’ve come to the right place. Please use the contact form to schedule a call with me. The first consult is always free.

Looking forward to hearing from you!

Sean Stafford

Work Experience

I assist companies large and small with one-time acquisitions or on an ongoing retainer basis.

Services

Do you need a domain purchased discretely? Social media handle acquisition help? Or perhaps a strategy to sell your domain to a big company? I can help.

Domain Acquisitions

Do you need a domain purchased discretely or help in contacting the owner? Contact me. I can work to secure domains where privacy and discreteness matter.

Social Media Handle Acquisitions

Social Media Handles can be a minefield to navigate. I have experience to help you through securing your brand.

In-House Domain Expert

Do you need ongoing domain consulting for your business? I can act as your in-house expert without having to put someone on full-time staff.

Domain Brokering

Have you been contacted about selling your domain, but don't know if you should or what to expect? I can walk you through it.